Walking donors through the giving process from their first interaction with your organization to their eventual conversion requires a dedicated effort from your nonprofit. However, even after processing your supporters’ gifts, there is often still one last step: providing a donation receipt.

Donation receipts are a fundamental part of tracking donations and maintaining transparent financial practices. While donation receipts are not complicated, nonprofit professionals less experienced with legal compliance matters may feel hesitant to make concrete decisions about their organization’s practices.

To help your nonprofit feel informed and secure when creating and distributing donation receipts, this article will cover four key compliance requirements:

- Include essential information.

- Distribute receipts when specific requirements are met.

- Send written receipts.

- Be aware of exceptions.

By following these items, you can provide your donors with more accurate, helpful receipts and set your nonprofit up for success for your own routine state filing requirements. Let’s get started.

1. Include essential information

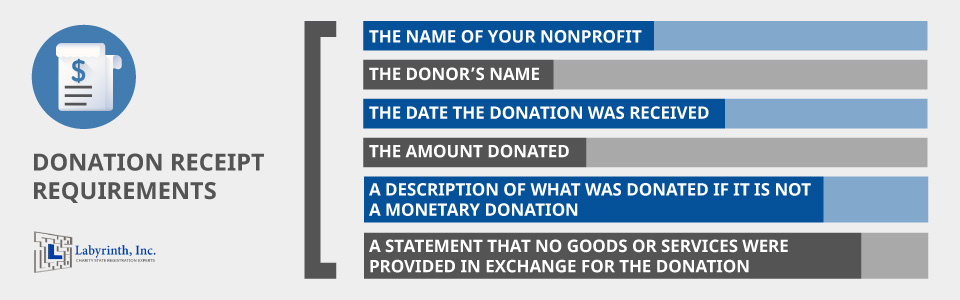

The IRS has dictated a few requirements that all official donor receipts must have. Additionally, there are a few extra elements that you can include on your receipts to create a better, more welcoming and transparent giving process. Labyrinth’s fundraising legal requirements guide specifies the six requirements your receipt must have:

- The name of your nonprofit

- The donor’s name

- The date the donation was received

- The amount donated

- A description of what was donated if it is not a monetary donation

- A statement that no goods or services were provided in exchange for the donation or a description and estimated value of the goods and services that were provided in exchange

For faith-based organizations, there is also an extra seventh requirement that donation receipts must specify that only intangible religious benefits were given in exchange for the donation. For example, this would include benefits such as the ability to attend weekly service at a local church free of charge, but would not include the travel expenses paid to go on a mission.

Remember that while donation receipts are meant to maintain transparency between your organization and your donors, it’s also your responsibility to protect your donors’ privacy. Your nonprofit will be responsible for keeping the required information on file for your donation receipts, as well as contact information in order to appropriately deliver the receipt.

2. Distribute receipts when specific requirements are met

While it’s good practice to give donation receipts to all of your donors, you are only legally required to when specific criteria are met. There are two situations in which you will be obligated to provide a donation receipt:

- A single donation of $250 or more. If a donation is worth $250 or more, you will need to provide a receipt with all of the previously listed requirements.

- Donations of $75 or more that were given in exchange for something of value. This requirement can be a bit vaguer than the previous one. For instance, if the goods or services given in exchange for the $75 are of negligible value, then a receipt will not be needed. This can include small prizes given in exchange for donating to a campaign. For example, a crowdfunding campaign might give a keychain or bumper sticker to donors who gave $100 or more. In this case the value of the prize would be considered negligible when compared to the amount donated, and a donation receipt would not be required.

If a donor requests a donation receipt, you should always make an effort to give them one, even if they don’t meet the above requirements. While small contributions will likely have less significant impact on either your donors’ or your nonprofit’s tax returns, providing requested receipts can help maintain a positive relationship between you and your supporters.

3. Send written receipts

Donation receipts must be written through either traditional or electronic means to be valid. While verbal confirmation can be a good start for confirming a donation, the eventual receipt will need to be written. To meet this requirement, many nonprofits rely on email to get in touch with donors and deliver receipts quickly.

While all donation receipts must have the same set of required information, some are better written, more helpful, and more engaging than others. You can improve your donation receipt emails or traditional letters with the following strategies:

- Use automatic messages. Automatic messages take the guesswork out of sending donation receipts. Consider using your donor engagement and messaging technology to set up automatic receipts for all donations to ensure each of your donors receives a receipt immediately.

- Add a thank you message. You should be sure to thank your donors after each contribution, and nonprofits who send donation receipts for all gifts can take the opportunity to combine the two. Instead of sending your donors multiple emails, add a thank you message at the top or bottom of your donation receipts.

- Create a template. If you’re unsure what to say in your donation receipts, consider using a template. Resources like Fundraising Letters’ donor thank you letters templates can be a good place to start for finding templates to work with. After selecting a template that works well for your receipts, be sure to customize it with details about your nonprofit to create a more unique, branded experience for your supporters.

When creating your donation receipts, carefully consider their formatting. While extra words of thanks and a reminder of your nonprofit’s mission are engaging details, ensure they don’t distract or obscure the essential information you need to communicate.

For example, you might consider creating a two column donation receipt with a message of thanks in one column and a list of the required information in the other. With this format, donors will be able to find the information they need with a quick scan and can also take the time to appreciate your thoughtful words of appreciation.

4. Be aware of exceptions

While for the most part donation receipts are relatively straightforward, there are a few exceptions to be aware of. Most of these complications will not dramatically change the contents of your donation receipt, and nonprofits that distribute donation receipts for all contributions are unlikely to have any problems.

However, it’s still a good idea to be knowledgeable about more complex donation situations, including:

- Insubstantial goods. As mentioned, you do not need to provide a donation receipt if you give donors insubstantial goods and services in exchange for their contributions. Whether or not something is “substantial” is determined by its monetary value. The IRS defines an insubstantial fair market value as not more than 2% of the donation or $50, whichever is less. Alternately, token branded items given in exchange for a donation of $25 or more are considered of insubstantial value. (Revenue Procedure 90-12)

- Intangible religious benefits. Churches and faith-based organizations need to reference the intangible religious benefits they provide on their donation receipts, but they do not need to go into any greater detail or estimate the benefits’ value.

- Matching gifts. Some of your supporters may work for a company with a matching gift program. This means that when they donate to a charitable organization, their employer will match their donation. For matching gifts, you’ll need to provide donation receipts to both the donor and their employer.

Additionally, the platform you collect donations through can sometimes complicate receipts. For example, Facebook allows a nonprofit’s supporters to run campaigns on their behalf at their own discretion. The funds collected through these fundraisers will be sent to your nonprofit, but you will not receive information about the individual donors. In this case, your nonprofit will not distribute receipts and instead rely on Facebook to do so.

Donation receipts are ultimately a tool that helps your nonprofit and your donors stay organized, while also facilitating a transparent relationship. Use your messaging and communication tools to create automatic donation receipts, and consider sending them to every donor, even when it’s not strictly required.